Categories

Recent Posts

- Football: Panthère du Ndé Wins Cameroon Cup 2025

- Fifa brings in new £45 ticket for 2026 World Cup

- President Sisiku Ayuk Tabe, top aides to appear before the Supreme Court

- Pressure mounts on Biya as speculation grows over possible replacement of Ngute

- 2025 is the year when Biya’s long rule finally lost its last convincing justification

Archives

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

Featured

2025 is the year when Biya’s long rule finally lost its last convincing justification

2025 is the year when Biya’s long rule finally lost its last convincing justification  Young Cameroonians: Build social capital to succeed

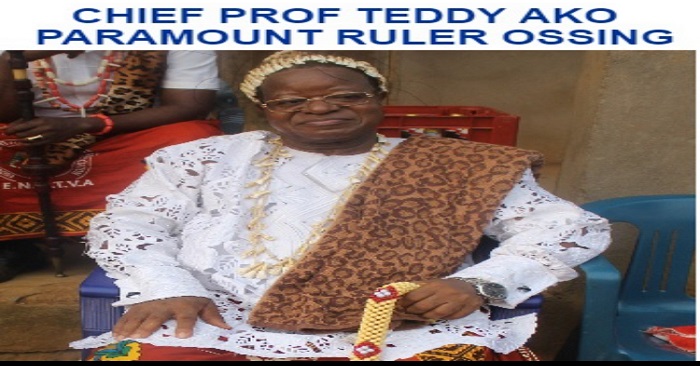

Young Cameroonians: Build social capital to succeed  Eulogy for HRH Nfor Professor Teddy Ako of Ossing

Eulogy for HRH Nfor Professor Teddy Ako of Ossing  Will Fr. Paul Verdzekov recognize the refurbished and rededicated Cathedral in Bamenda were he to return today?

Will Fr. Paul Verdzekov recognize the refurbished and rededicated Cathedral in Bamenda were he to return today?  Cameroon apparently under a de facto federalism

Cameroon apparently under a de facto federalism

Most Commented Posts

4 Anglophone detainees killed in Yaounde

4 Anglophone detainees killed in Yaounde

18 comments Chantal Biya says she will return to Cameroon if General Ivo Yenwo, Martin Belinga Eboutou and Ferdinand Ngoh Ngoh are sacked

Chantal Biya says she will return to Cameroon if General Ivo Yenwo, Martin Belinga Eboutou and Ferdinand Ngoh Ngoh are sacked

13 comments The Anglophone Problem – When Facts don’t Lie

The Anglophone Problem – When Facts don’t Lie

12 comments Anglophone Nationalism: Barrister Eyambe says “hidden plans are at work”

Anglophone Nationalism: Barrister Eyambe says “hidden plans are at work”

12 comments Largest wave of arrest by BIR in Bamenda

Largest wave of arrest by BIR in Bamenda

10 comments

Latest Tweets

Featured

-

Football: Panthère du Ndé Wins Cameroon Cup 2025

-

Fifa brings in new £45 ticket for 2026 World Cup

-

President Sisiku Ayuk Tabe, top aides to appear before the Supreme Court

-

Pressure mounts on Biya as speculation grows over possible replacement of Ngute

-

2025 is the year when Biya’s long rule finally lost its last convincing justification

-

Armed Mbororo tribesmen killed 8 in Southern Cameroons’ new war

-

Southern Cameroons Crisis: Atanga Nji Boys abduct 8 people en route to Kumbo

© Cameroon Concord News 2025

16, December 2017

US: Republicans unveils final version of tax bill, voting next week 0

US Republicans have unveiled the final draft of their dramatic tax bill which they are racing to send to President Donald Trump’s desk by Christmas.

The bill picked up crucial support Friday from two wavering senators, Marco Rubio (R-Fla.) and Bob Corker (R-Tenn.), ahead of planned votes by lawmakers early next week.

The House is expected to vote on the bill on Tuesday and then the Senate will vote. If passed, the measure would deliver a major legislative victory to Trump and his Republican allies.

“I believe that this once-in-a-generation opportunity to make US businesses domestically more productive and internationally more competitive is one we should not miss,” Corker said in a statement.

The legislation by the House-Senate conference committee would massively change the tax system, cut rates for many individuals and businesses and place new limitations on tax breaks.

The bill also includes a targeted change to the Affordable Care Act, known as Obamacare, Republicans have long sought to dismantle.

“I’m very excited about this moment. It’s been 31 years in the making and took a lot of hard work by a lot of people to make this day happen. I’m proud of the Tax Cuts and Jobs Act,” said Rep. Kevin Brady (R-Texas), the chairman of the House Ways and Means Committee.

“I know everyone’s lives will be better off under tax reform,” added Brady, who played a lead role in crafting the bill.

Under the final bill, the top individual rate would be reduced from 39.6 percent to 37 percent, which is lower than the top rate in the original bills the House and Senate passed.

In addition, the corporate tax rate would be lowered from 35 percent to 21 percent, up from 20 percent in the original bills.

While GOP lawmakers and the White House assert the economic growth from the bill will offset the revenue losses, most analysts disagree.

Also, Democrats, who are expected to stay united in opposing the measure, argue the bill would benefit wealthy individuals and corporations more and would wind up raising taxes on some middle-class families.

Source: Presstv