Categories

Recent Posts

- Football: Panthère du Ndé Wins Cameroon Cup 2025

- Fifa brings in new £45 ticket for 2026 World Cup

- President Sisiku Ayuk Tabe, top aides to appear before the Supreme Court

- Pressure mounts on Biya as speculation grows over possible replacement of Ngute

- 2025 is the year when Biya’s long rule finally lost its last convincing justification

Archives

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

Featured

2025 is the year when Biya’s long rule finally lost its last convincing justification

2025 is the year when Biya’s long rule finally lost its last convincing justification  Young Cameroonians: Build social capital to succeed

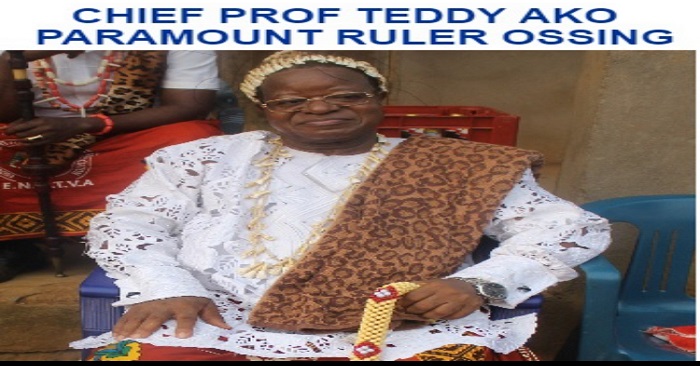

Young Cameroonians: Build social capital to succeed  Eulogy for HRH Nfor Professor Teddy Ako of Ossing

Eulogy for HRH Nfor Professor Teddy Ako of Ossing  Will Fr. Paul Verdzekov recognize the refurbished and rededicated Cathedral in Bamenda were he to return today?

Will Fr. Paul Verdzekov recognize the refurbished and rededicated Cathedral in Bamenda were he to return today?  Cameroon apparently under a de facto federalism

Cameroon apparently under a de facto federalism

Most Commented Posts

4 Anglophone detainees killed in Yaounde

4 Anglophone detainees killed in Yaounde

18 comments Chantal Biya says she will return to Cameroon if General Ivo Yenwo, Martin Belinga Eboutou and Ferdinand Ngoh Ngoh are sacked

Chantal Biya says she will return to Cameroon if General Ivo Yenwo, Martin Belinga Eboutou and Ferdinand Ngoh Ngoh are sacked

13 comments The Anglophone Problem – When Facts don’t Lie

The Anglophone Problem – When Facts don’t Lie

12 comments Anglophone Nationalism: Barrister Eyambe says “hidden plans are at work”

Anglophone Nationalism: Barrister Eyambe says “hidden plans are at work”

12 comments Largest wave of arrest by BIR in Bamenda

Largest wave of arrest by BIR in Bamenda

10 comments

Latest Tweets

Featured

-

Football: Panthère du Ndé Wins Cameroon Cup 2025

-

Fifa brings in new £45 ticket for 2026 World Cup

-

President Sisiku Ayuk Tabe, top aides to appear before the Supreme Court

-

Pressure mounts on Biya as speculation grows over possible replacement of Ngute

-

2025 is the year when Biya’s long rule finally lost its last convincing justification

-

Armed Mbororo tribesmen killed 8 in Southern Cameroons’ new war

-

Southern Cameroons Crisis: Atanga Nji Boys abduct 8 people en route to Kumbo

© Cameroon Concord News 2025

9, January 2024

Biya’s new fiscal measures leading to salary cuts 0

Effective January 1, 2024, with the implementation of Cameroon’s 2024 fiscal law, the government has introduced new tax measures expected to lead to an inevitable decrease in salaries for some workers. According to Célestin Tawamba, the leader of Cameroonian business leaders, these measures are projected to result in a salary reduction ranging from 5% to 25% in various companies.

One significant measure involves the expansion of the list of in-kind benefits subject to the income tax scale. The related circular signed on December 29, 2023, by Finance Minister Louis Paul Motazé specified that “personal income tax (IRPP) in the salaries and wages category has been rationalized by fully taxing all benefits in kind paid in cash. The list of benefits in kind subject to estimation for the determination of the taxable base of IRPP in the salaries and wages category has been extended to include: telephone 5%, fuel 10%, security 5%, and internet 5%”.

This means that along with existing benefits in kind, such as housing allowances (15%), electricity (4%), water (2%), domestic help (5% each), vehicles (10% each), and food (10%), previously subject to the income tax scale, the State is adding, as of January 1, 2024, phone allowances (5%), fuel allowances (10%), security allowances (5%), and internet allowances (5%). According to information from sources within the General Tax Directorate, under this new provision of the 2024 fiscal law, a worker receiving, for example, a phone allowance of 50,000 CFA per month will only see 5% of that amount (2,500 CFA) exempt from IRPP. The entire remaining allowance, i.e., 47,500 CFA, will be subject to IRPP.

Significant deductions for high incomes

Similarly, a worker receiving a fuel allowance of the same amount (50,000 CFA) will have IRPP deducted from 45,000 CFA, while 5,000 CFA will be exempt from paying this tax. Considering that the IRPP rate for salaries below 2 million CFA is 10% in Cameroon, the worker in this scenario (assuming their salary is less than 2 million CFA, ed) will lose 4,500 CFA from their fuel allowance due to the payment of IRPP to the tax authorities, corresponding to a decrease in their salary by 4,500 CFA. This reduction will be even more significant as the same operation is applied to the phone, security, and internet allowances.

It is worth noting that the in-kind benefits targeted by this new provision of the 2024 fiscal law related to IRPP concern higher-income workers who generally enjoy substantial salary packages. In other words, the 2024 fiscal law will allow for increased tax revenue collection from higher salaries. The larger the salary, the greater the deduction for IRPP on in-kind benefits, as the IRPP rate varies depending on income levels. It is 10% for incomes below 2 million CFA per month, 15% for incomes between 2 and 3 million CFA, 25% for incomes between 3 and 5 million CFA, and 35% for incomes exceeding 5 million CFA.

Moreover, the government, in the 2024 fiscal law, caps the flat-rate deduction at 4.8 million CFA per year (400,000 CFA per month) for the 30% deduction from the gross annual salary. “Only salaries exceeding 1,333,000 CFA per month are affected by this limitation,” the Minister’s note read.

A worker with an annual salary income totaling 100 million CFA will now only benefit from a maximum deduction of 4.8 million CFA (the rest being subject to IRPP payment), compared to the previous 30 million CFA. The nearly 25 million CFA that were previously exempt from IRPP before the new fiscal law came into effect will now be added to the taxable base, resulting in a significant loss of income to the tax authorities.

Source: Business in Cameroon