24, April 2024

Historic agreement between Nigeria and Cameroon to tackle wildlife crime 0

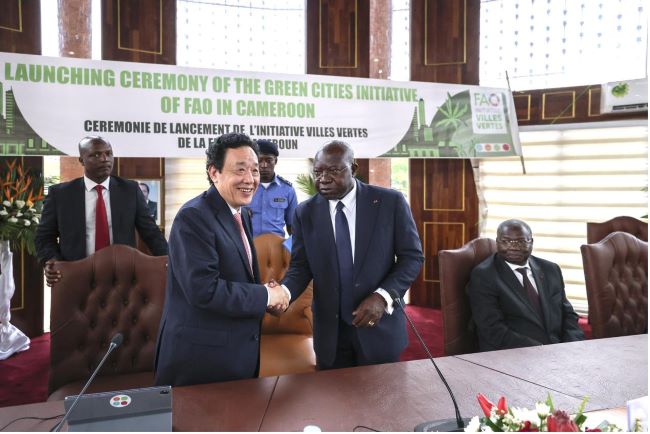

Environmental ministers from Nigeria and Cameroon have made conservation history by signing a highly-anticipated Memorandum of Understanding to address the illegal trade in wild species.

The agreement promises to tackle wildlife crime across the 2,000km shared border between the two countries. Tropical timber such as rosewood, elephant ivory, pangolin scales, and other wildlife commodities are among the typical high-value items that are poached and smuggled between countries.

The MoU, signed by Nigeria’s Environment Minister and Cameroon’s Minister for Forestry and Wildlife, will address wildlife poaching and illegal trade through a framework to jointly implement transboundary wildlife programmes, intelligence sharing protocols, and enhanced enforcement cooperation.

“This agreement marks a critical milestone for a nature-positive future”, said Richard Scobey, Executive Director of TRAFFIC.

TRAFFIC is proud to have supported development of this decisive process to crack down on crime and move towards legal and sustainable use of wild species that benefits both local communities and entire nations.”

Cameroon and Nigeria’s shared border has been routinely exploited by wildlife traffickers who target both local and migratory species. The UN Office on Drugs and Crime (UNODC), as well as extensive TRAFFIC investigations, have identified each country as both major sources and transit hubs for the global illegal trade in wild species.

The transboundary nature of wildlife crime and the social, developmental, and economic issues that drive it, require urgent cooperation between countries. Wildlife poaching, trafficking, and associated illegal activity has destabilising national repercussions, contributing to poverty, food and income instability, biodiversity collapse, and national revenue loss.

The agreement signed on Friday exemplifies an overall approach that is needed to counter such threats.

It marks a strong positive step in responding to the devastating environmental and human consequences of the illegal trade in wild species through a formalised management, conservation, sustainability, and enforcement framework.

TRAFFIC is pleased to have played a leading role in supporting Parties reach this agreement by providing extensive insights into domestic and international trade dynamics, technical advice into the development of the MoU itself, and funding support via local projects.

We congratulate both governments on this significant agreement and look forward to supporting subsequent efforts to preserve the rich biodiversity of both nations and support the sustainable and legal use of natural resources.”

Culled from Traffic

24, April 2024

Biya regime delays bond sale amid regional market strain 0

The Cameroon government has postponed its planned 2024 bond sale, originally slated for April, due to market saturation caused by Gabon and the Central African Development Bank (BDEAC). A source within the Ministry of Finance Treasury Department revealed ongoing negotiations for the delay.

With regional capital markets facing adversity, marked by difficulty in accessing funds, Cameroon opts for caution, refraining from pursuing significant borrowing. Gabon and BDEAC, preceding Cameroon with bond issuances totaling CFA200 billion earlier in 2024, faced challenges in attracting subscriptions, leading to extending their bond closure dates.

Despite offering various interest rates and maturity terms, both Gabon and BDEAC had to prolong their bond subscription deadlines due to underwhelming responses from investors. This move aims to grant them more time and a better opportunity to attract hesitant investors.

In light of this cautious market environment, Cameroon, accustomed to controlled interest rates, refrains from significant borrowing. The country’s preference for controlled rates contrasts with the current trend of rising interest rates, a consequence of the Central African Central Bank’s austerity monetary policy to combat inflation by tightening liquidity. Amid uncertain market conditions, Cameroon prepares to preserve its treasury amidst difficulty in accessing fresh funds. The government plans to repurchase certain bonds issued on the regional market, scheduled for early May, totaling between CFA150 billion and CFA200 billion. This strategy aims to extend repayment dates for bonds nearing maturity, ensuring liquidity for essential priorities.

Source: Business in Cameroon