Categories

Recent Posts

- Nigeria apologises over Burkina Faso military flight that saw 11 servicemen detained

- Cameroon eVisa platform flags abnormal bank charges on visa payments

- Football: Panthère du Ndé Wins Cameroon Cup 2025

- Fifa brings in new £45 ticket for 2026 World Cup

- President Sisiku Ayuk Tabe, top aides to appear before the Supreme Court

Archives

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

Featured

2025 is the year when Biya’s long rule finally lost its last convincing justification

2025 is the year when Biya’s long rule finally lost its last convincing justification  Young Cameroonians: Build social capital to succeed

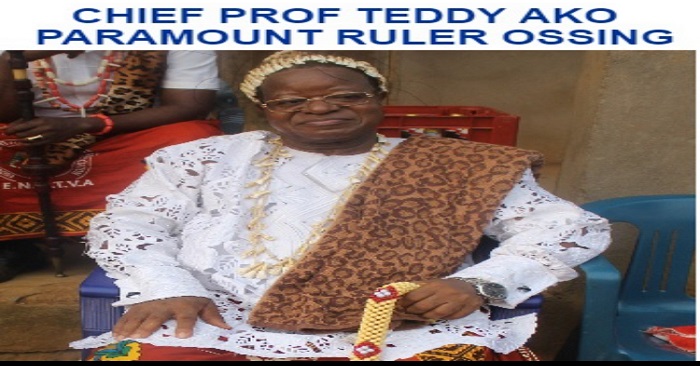

Young Cameroonians: Build social capital to succeed  Eulogy for HRH Nfor Professor Teddy Ako of Ossing

Eulogy for HRH Nfor Professor Teddy Ako of Ossing  Will Fr. Paul Verdzekov recognize the refurbished and rededicated Cathedral in Bamenda were he to return today?

Will Fr. Paul Verdzekov recognize the refurbished and rededicated Cathedral in Bamenda were he to return today?  Cameroon apparently under a de facto federalism

Cameroon apparently under a de facto federalism

Most Commented Posts

4 Anglophone detainees killed in Yaounde

4 Anglophone detainees killed in Yaounde

18 comments Chantal Biya says she will return to Cameroon if General Ivo Yenwo, Martin Belinga Eboutou and Ferdinand Ngoh Ngoh are sacked

Chantal Biya says she will return to Cameroon if General Ivo Yenwo, Martin Belinga Eboutou and Ferdinand Ngoh Ngoh are sacked

13 comments The Anglophone Problem – When Facts don’t Lie

The Anglophone Problem – When Facts don’t Lie

12 comments Anglophone Nationalism: Barrister Eyambe says “hidden plans are at work”

Anglophone Nationalism: Barrister Eyambe says “hidden plans are at work”

12 comments Largest wave of arrest by BIR in Bamenda

Largest wave of arrest by BIR in Bamenda

10 comments

Latest Tweets

Featured

-

Nigeria apologises over Burkina Faso military flight that saw 11 servicemen detained

-

Cameroon eVisa platform flags abnormal bank charges on visa payments

-

Football: Panthère du Ndé Wins Cameroon Cup 2025

-

Fifa brings in new £45 ticket for 2026 World Cup

-

President Sisiku Ayuk Tabe, top aides to appear before the Supreme Court

-

Pressure mounts on Biya as speculation grows over possible replacement of Ngute

-

2025 is the year when Biya’s long rule finally lost its last convincing justification

© Cameroon Concord News 2025

4, July 2024

IMF completes reviews of Cameroon’s Extended Credit Facility 0

The Executive Board of the International Monetary Fund (IMF) completed today the sixth reviews under Cameroon’s Extended Credit Facility (ECF) and the Extended Fund Facility (EFF) arrangements. The completion of the ECF-EFF reviews allows for an immediate disbursement of SDR 55.2 million (about US$ 72.7 million), bringing total disbursements under the arrangements to SDR 483 million (US$ 644.6 million). The Executive Board also completed the first review under the Resilience and Sustainability Facility (RSF) arrangement. Completion of this review makes available SDR 34.5 million (US$ 45.4 million).

The Executive Board approved waivers of nonobservance of two performance criteria on the floor on the non-oil primary fiscal balance at end-December 2023 and the continuous zero ceiling on the accumulation of new external payment arrears on the ground that the nonobservance was minor and temporary. In addition, the Executive Board approved a waiver of applicability for four end-June 2024 performance criteria, for which data are not yet available and there is no evidence that they were not observed.

Cameroon’s three-year ECF-EFF arrangements were originally approved by the IMF Executive Board for a total amount of SDR 483 million (US$ 689.5 million, or 175 percent of quota) in July 2021. An extension of these arrangements of 12 months was approved in December 2023 to allow more time to implement the policies and reforms, and access was augmented by SDR 110.4 million (US$ 145.4 million, or 40 percent of quota). The 18-month RSF was approved by the Executive Board in January 2024 in the amount of SDR 138 million (US$ 181.7 million, or 50 percent of quota).

Cameroon’s ECF-EFF-supported program continues to provide a strong anchor for the authorities’ economic program, notably efforts to achieve post-COVID-19 recovery, restore the country’s fiscal and external sustainability and unlock inclusive and private sector-driven growth. The RSF supports Cameroon’s efforts to adapt to and mitigate the impact of climate change, reinforce the growing engagement of development partners and other stakeholders in climate-resilient development and catalyze additional climate financing.

Preliminary data indicate that Cameroon’s post-COVID-19 recovery continued last year, with overall economic growth estimated at 3.3 percent, slightly below expectations due to external and domestic factors, including supply chain and energy disruptions and a contraction of oil production. Growth is expected to pick up to 3.9 percent in 2024 and remain above 4 percent in the medium term as domestic demand strengthens and the external environment stabilizes. Inflation moderated to 5.9 percent at end-2023. A continued decline to 5.5 percent is expected by end-2024.

At the conclusion of the Executive Board’s discussion, Mr. Kenji Okamura, Deputy Managing Director and Acting Chair, made the following statement:

“Cameroon’s economic growth continues despite the challenging domestic and external environment. Moreover, while the balance of risks remains tilted to the downside, the country’s medium-term outlook is favorable. Although performance under the Fund-supported program has been mixed, the ECF-EFF arrangements are supporting the authorities’ efforts to maintain macroeconomic stability and implement priority reforms to promote inclusive growth. Moreover, the authorities are committed to implementing corrective measures to improve program performance and accelerate reforms.

“To preserve macroeconomic stability, it is important to maintain a fiscal path in line with program objectives. This implies strengthening domestic non-oil revenue mobilization and public financial management. Limiting spending done through exceptional procedures is essential to achieve budget discipline and integrity.

“Cameroon’s financial soundness indicators have generally improved, but vulnerabilities remain. The commitment by the authorities to advance bank recapitalization in compliance with the COBAC regulations and Basel capital adequacy framework is welcome.

“To improve the business environment and support private sector-led inclusive growth, it is critical to implement governance reforms, address corruption vulnerabilities, and strengthen the AML/CFT regime.

“The authorities have made commendable progress under the RSF, which is helping Cameroon integrate climate considerations into its institutional and regulatory frameworks and enhance its capacity to adapt and mitigate the effects of climate change. It is essential to maintain the reform momentum to further strengthen the institutional framework for climate policies, build resilience to climate shocks, and catalyze new investments from donors and the private sector.”

Source: IMF