Categories

Recent Posts

- Nigeria apologises over Burkina Faso military flight that saw 11 servicemen detained

- Cameroon eVisa platform flags abnormal bank charges on visa payments

- Football: Panthère du Ndé Wins Cameroon Cup 2025

- Fifa brings in new £45 ticket for 2026 World Cup

- President Sisiku Ayuk Tabe, top aides to appear before the Supreme Court

Archives

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

Featured

2025 is the year when Biya’s long rule finally lost its last convincing justification

2025 is the year when Biya’s long rule finally lost its last convincing justification  Young Cameroonians: Build social capital to succeed

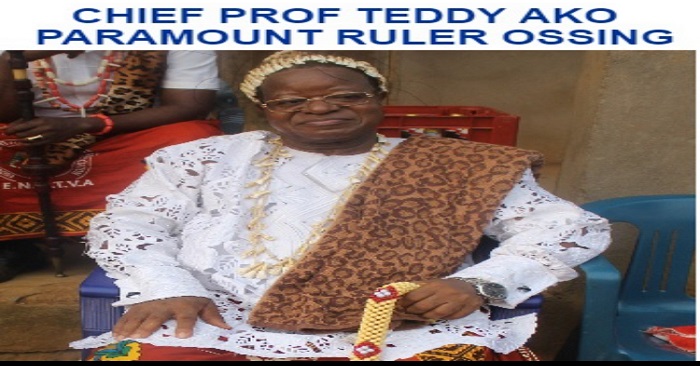

Young Cameroonians: Build social capital to succeed  Eulogy for HRH Nfor Professor Teddy Ako of Ossing

Eulogy for HRH Nfor Professor Teddy Ako of Ossing  Will Fr. Paul Verdzekov recognize the refurbished and rededicated Cathedral in Bamenda were he to return today?

Will Fr. Paul Verdzekov recognize the refurbished and rededicated Cathedral in Bamenda were he to return today?  Cameroon apparently under a de facto federalism

Cameroon apparently under a de facto federalism

Most Commented Posts

4 Anglophone detainees killed in Yaounde

4 Anglophone detainees killed in Yaounde

18 comments Chantal Biya says she will return to Cameroon if General Ivo Yenwo, Martin Belinga Eboutou and Ferdinand Ngoh Ngoh are sacked

Chantal Biya says she will return to Cameroon if General Ivo Yenwo, Martin Belinga Eboutou and Ferdinand Ngoh Ngoh are sacked

13 comments The Anglophone Problem – When Facts don’t Lie

The Anglophone Problem – When Facts don’t Lie

12 comments Anglophone Nationalism: Barrister Eyambe says “hidden plans are at work”

Anglophone Nationalism: Barrister Eyambe says “hidden plans are at work”

12 comments Largest wave of arrest by BIR in Bamenda

Largest wave of arrest by BIR in Bamenda

10 comments

Latest Tweets

Featured

-

Nigeria apologises over Burkina Faso military flight that saw 11 servicemen detained

-

Cameroon eVisa platform flags abnormal bank charges on visa payments

-

Football: Panthère du Ndé Wins Cameroon Cup 2025

-

Fifa brings in new £45 ticket for 2026 World Cup

-

President Sisiku Ayuk Tabe, top aides to appear before the Supreme Court

-

Pressure mounts on Biya as speculation grows over possible replacement of Ngute

-

2025 is the year when Biya’s long rule finally lost its last convincing justification

© Cameroon Concord News 2025

11, September 2019

Russia, China eye first bonds in yuan amid US trade war 0

Russia plans to issue its first yuan-denominated bond as the country is working with China to cut reliance on the US greenback, Russian broadcaster RT reports.

China and Russia are drawing increasingly close amid a changing global landscape marked by President Donald Trump’s “America First” policy and his trade war which involves multiple battles with US allies and others alike.

Beijing and Moscow have been planning yuan bonds since 2016, but the plan has been postponed several times. According to RT, Russia now expects to issues its first sovereign debt in the Chinese currency, officially called renminbi, by the end of the year or early next year.

Both countries are concerned about “the dollar hegemony” and see the launch as a stepping stone in their bid to break the dominion up, the network said.

“It’s a step towards de-dollarization,” investment strategist with Premier BCS Anton Bakhtin told RT. “Secondly, it’s an additional bridge between us and the Chinese investors.”

As tensions escalate with the US, world countries are becoming increasingly worried about Washington using global reliance on the dollar as a weapon.

However, it will take much more time to fully shift away from the greenback and countries are looking for additional financial instruments as protection.

Both China and Russia have been stockpiling gold. Since December, the People’s Bank of China has reportedly added about 100 tonnes of gold to its reserves. Russia has bought 106 tonnes of the precious metal this year.

Over the past decade, Russia has more than quadrupled its gold reserves to more than 2,200 tonnes and now owns the fifth-largest stockpile by country. China’s reserves reportedly stand at more than 1,950 tonnes.

Russian President Vladimir Putin has taken a special interest in breaking up America’s “exorbitant privilege” in the words of former French President Charles de Gaulle through the dollar hegemony.

In June, Putin urged five major emerging economic powers – Brazil, Russia, India, China and South Africa, known as BRICS – to accelerate developing a system that could replace the dollar.

China, on the other hand, is on a campaign to make the renminbi a global reserve currency and its rising gold reserves could add to world confidence in the currency.

China’s launch of yuan-denominated Shanghai futures in March generated a lot of enthusiasm around the world.

Experts say the new futures contract traded on the Shanghai International Energy Exchange is now on course to become an alternative international oil benchmark not priced in dollars.

Source: Presstv